Where’ve you been WTM?

Hello all! Thank you to those have been reaching out and checking in on the Slack updates. Life got pretty hectic recently, Thomas was wandering through Mexico surviving on crickets, and other insects (he claims are delicacies..but I’ve tried a scorpion in Thailand and it was a far cry from a delicacy in my book), in any case we took a little break but we’ll be back in your inbox’s every Monday morning. If there’s anything you’d like to see covered from the last few weeks let us know in our Slack Channel. Thank you all for the continued support!

What the Market?

In the midst of growing geopolitical risks, a damaged supply chain, and the easing of pandemic measures, Mr. Market is beginning to realize that things may get worse before they get better. Inflation is weighing heavy on Mr. Market’s mind, the latest CPI reading showed inflation accelerating to an 8.5% annual rate, a multi-decade high. In a typical response to rising inflation, the ole manic depressive started selling off government bonds which drove the US 10yr yield to a 3-year high of 2.87%. Analysts are adjusting their models as the Fed is expected to raise the federal funds rate by at least 50 basis points in May. In the meantime, volatility may increase as earnings season is about to start ramping up.

What’s driving the market?

What’s in the Earnings?: Other than the troubling economic news, Mr. Market has been looking forward to seeing the results of Q1. Analysts are looking to see how corporations have navigated a tightening labor market with consistently higher inflationary pressures and potentially higher interest rates. According to Factset, the estimated earnings growth rate for the quarter is 5.1%, the slowest since Q4 2020. Although the results from major financial institutions last week were mixed, 77% of companies have beat expectations so far. Keep an eye on the latest commentary from major market movers.

What’s an investor to do?

Portfolio Management

The market continues to wind down from its insane run over the past 2 years and readjusts to the current macro environment. The sensitive food and energy sectors continue to face inflationary pressures, and growth/speculative investments have taken a beating this quarter. With inflation and rates continuing to rise, growing geopolitical uncertainty, and the subsequent decline in consumer confidence, speculative investments will likely continue to face strong headwinds. If you’re still sitting on a primarily growth and tech portfolio - then it might be worth seeing someone about your masochist tendencies (perhaps a therapist and a financial planner, maybe someone who specializes in both?)

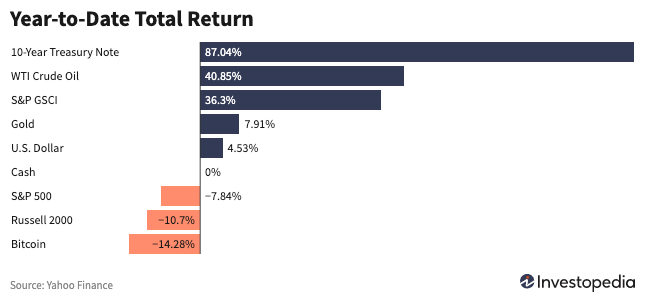

Here, maybe this chart will help put things in perspective:

It may just be time to buy into some commodities and value stocks, corporate bonds in strong industries wouldn’t be a terrible idea either to counter inflation with minimal risk. If you’re truly concerned about your inner financial masochist, remember you can always reach us on our slack channel.

Keep an eye on the economy

Housing Data: A side effect from rising inflation, and consequently, higher interest rates is the behavior of housing markets. More updates on how the US housing market is doing will include March’s housing starts and existing home sales, which are expected to decline vs. February as mortgage rates continue rising (30yr mortgages currently at 3yr highs, 5.13%) and constant price gains have maimed demand.

See here for the full economic calendar

The Curious Investor

AT&T completes its spinoff of Warner Bros. Discovery (WBD): Ever since reading Joel Greenblatt’s, You Can be a Stock Market Genius, we’ve loved spinoffs. The incentives behind a spinoff are nearly always beneficial to shareholders. A company will engage in a spinoff when it has multiple businesses under its umbrella that operate in different sectors or industries all together. The spinoff makes it easier for investors to evaluate the individual companies rather than trying to compare a conglomerate to its direct competitors. In this case, AT&T split its telecom business apart from its media business, Warner Bros. Discovery. Now both AT&T (T) and Warner Bros. (WBD) can be unburdened from each other’s industry comparables and market pressures. This type of financial engineering can often create quick short-term opportunities as the split stocks are unburdened and potential long-term gains if one of the companies was not properly evaluated. This opportunity passes quickly - keep an eye on both stocks to determine if you’d want to play the spinoff, and separately ask if you’d like to invest in the company beyond the spinoffs impact. If you missed this one, keep your eye out for future spinoffs!

Emerging Opportunity - Climate Tech: Amid global pressures to reduce reliance on gas (e.g., Europe) and a strong domestic push towards renewables, VCs are scaling up Climate Software investments. Keep your eye on clean tech projects coming out.

New ways to enter the cannabis market: 14 countries in Africa are positioning themselves to be the top supplier of pharmaceutical cannabis products for Germany and the EU

Upcoming Earnings

Financial Services: Bank of America, Charles Schwab, BNY Mellon, Nasdaq, American Express

Airlines: Alaska Air Group, Spirit

Industrials: Lockheed Martin

Consumer Defensive: Johnson & Johnson, Proctor and Gamble

What we’re vibing:

Andrew Schulz: Yes, just vibing this hilarious man. Schulz made his big splash on the scene just before the pandemic and we think he truly has what it takes to be one of the comic greats. He has tons of content on the Tube of You. So we’ll start you off with this gem about New Yorker’s and our ancient radiators.

Attack on Titan: After numerous recommendations and raves from friends, I finally dove into the manga-based series. Suffice to say…I’m hooked. Set in a historical medieval dystopia in which humanity finds itself pushed to the brink of extinction by the sudden presence of giants (titans) - the show is not for the light-hearted. The twists, developments, and action will keep you on the edge of your seat trying to unravel the mystery of the titans origins.

Resources

A content guide to investing (books, books, books!)

Disclaimer

This writing is for informational purposes only and the author/s undertake/s no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. The author/s expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. The postings on this site are our own and do not necessarily represent the postings, strategies or opinions of our employers.